Let's Get Started

Remodel refinance specialists

Expert Guidance

Every Step of the Way

We understand that refinancing for home renovations can seem complex and daunting. That’s why our team of dedicated loan originators is here to guide you through every step of the process. With a deep understanding of the intricacies of refinancing and a passion for helping you achieve your dream home, our experts are more than just financial advisors – they’re your partners in making informed, confident decisions. From exploring your options to finalizing the details, we’re committed to ensuring a smooth, transparent, and personalized experience.

Our loan originators take the time to understand your unique needs and goals. Whether you’re looking to add a new room, update your kitchen, or consolidate debt along with your renovation project, we’re here to provide tailored solutions. We believe in clear communication and will keep you informed at every stage, demystifying the complexities of mortgage refinancing. You’re not just securing funding for your home renovation; you’re gaining a team of experts dedicated to helping you realize your vision with financial peace of mind.

Common Questions

Remodel Refinance is a specialized cash-out refinancing option that allows homeowners to tap into their home equity to fund renovations. It’s a smart way to finance your home improvement projects while potentially consolidating other debts, all under a potentially more favorable interest rate than personal loans or credit cards

“By choosing to refinance, you can access the equity you’ve built up in your home and use it for renovations. This means you can fund your home makeover without the need for high-interest personal loans or depleting your savings, often with the benefit of a tax-deductible interest (subject to IRS rules).

Refinancing may change your mortgage interest rate. The new rate can vary based on your credit score, market conditions, and the amount of equity in your home. Our loan originators will work with you to find the most advantageous rate and terms based on your specific situation.

Absolutely. A cash-out refinance for home renovations also offers the opportunity to consolidate other high-interest debts, like credit card balances or personal loans, into your mortgage. This can simplify your finances by having a single, potentially lower interest payment.

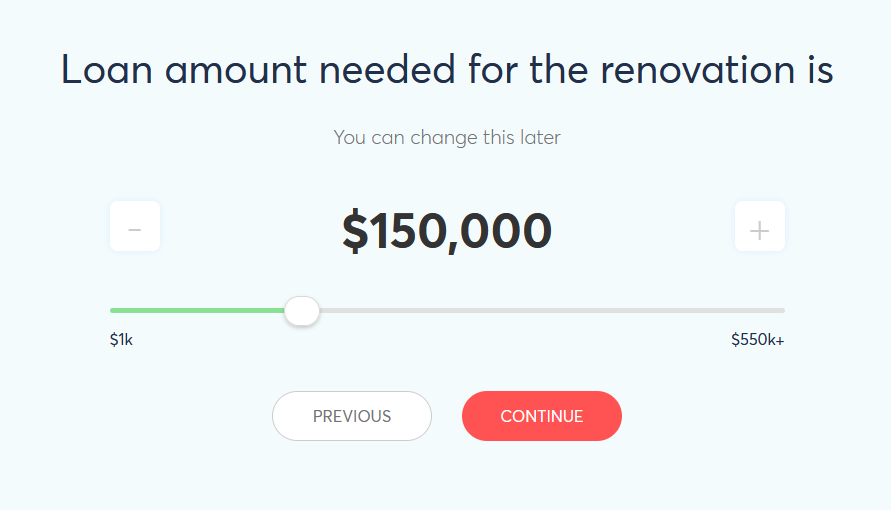

The amount you can borrow depends on several factors, including the current value of your home, your credit history, and your existing mortgage balance. Our experts will help you understand your borrowing capacity and guide you through the best options for your renovation goals.

Our loan originators are committed to providing comprehensive support throughout your refinancing journey. From initial consultation to final closing, they’ll offer personalized advice, clear explanations of your options, and continuous updates on the status of your application. They’re here to ensure your refinancing experience is seamless and successful.